The government has kicked off a consultation on tax reforms to ensure clean hydrogen production isn’t penalised, as part of a wider effort to modernise the tax system and support the shift to low-carbon energy.

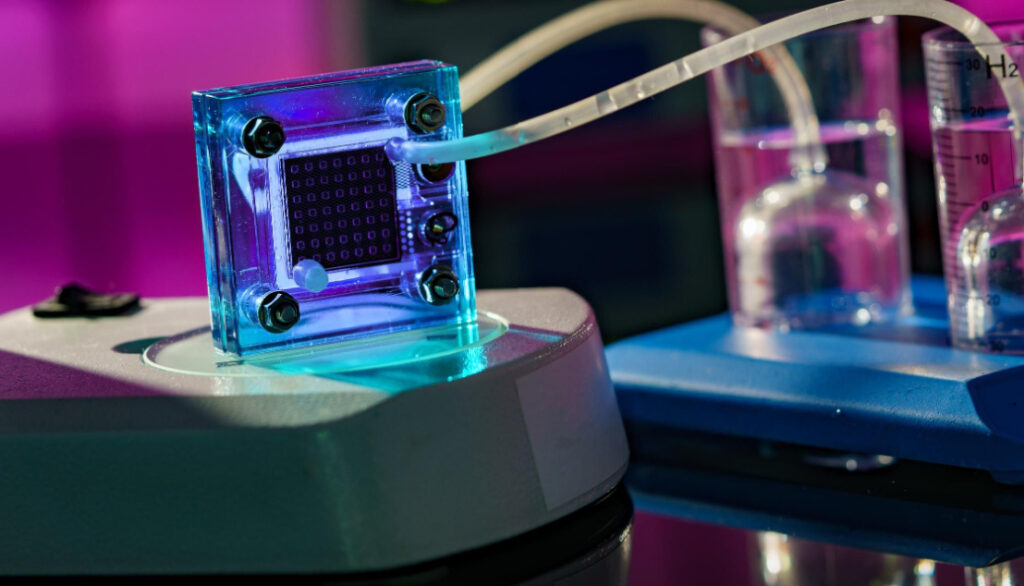

Under current rules, businesses producing hydrogen through electrolysis—where electricity is used to split water into hydrogen and oxygen—face additional costs due to the Climate Change Levy (CCL).

But with clean hydrogen seen as a crucial tool in decarbonising heavy industry and transport, ministers want to scrap these charges and review how CCL fits into the UK’s evolving energy landscape.

The move to remove CCL costs from electricity used in hydrogen production is part of the government’s broader push to create a tax system that fosters economic growth and energy transition.

Ministers argue that charging businesses extra for producing hydrogen—especially when powered by renewables—makes little sense when the country is trying to cut emissions.

Hydrogen’s Role in a Low-Carbon Future

Hydrogen is being positioned as a game-changer for industries that are difficult to electrify, such as steelmaking, chemicals and heavy transport.

When produced using renewable electricity, it’s classified as ‘green hydrogen’—a fully clean energy source. Even hydrogen made with low-carbon electricity from nuclear or gas with carbon capture can play a major role in cutting emissions.

However, producing hydrogen through electrolysis is highly energy-intensive and because electricity is subject to the CCL, producers are currently being hit with extra charges.

In 2023-24 alone, CCL raised £1.2 billion, with energy suppliers collecting the tax from businesses and the public sector.

Ministers now say that if the UK is serious about scaling up hydrogen, these outdated charges need to go. Scrapping the levy on electricity used for electrolysis would lower production costs and help attract investment into the sector.

Backing Hydrogen Projects

Alongside the tax review, the government has already pledged significant financial backing for hydrogen projects.

At the Autumn Budget 2024, ministers confirmed £90 million in capital grants for 11 projects through the first Hydrogen Allocation Round (HAR1).

These projects will also receive revenue support under the Hydrogen Production Business Model, designed to bridge the cost gap between hydrogen and fossil fuels.

This means hydrogen producers will get financial help to compete with traditional fuels while the industry scales up. The HAR1 projects will be spread across the UK, helping drive investment into local economies and boosting clean energy jobs.

The first contracts under HAR1 have now been signed, marking a milestone for the sector. Removing the CCL costs on electrolysis will further strengthen the UK’s position as a leader in hydrogen technology and support long-term growth.

Why a Consultation?

The government wants to ensure the tax system is fit for purpose as energy markets evolve. CCL was introduced in 2001 to encourage businesses to improve energy efficiency and reduce emissions but the landscape has changed dramatically since then.

With renewables playing a much bigger role in the energy mix, policies need to be updated to reflect these shifts.

By launching this consultation, ministers are seeking views on how best to remove CCL costs from hydrogen production without causing unintended consequences.

They are also looking at whether other parts of the levy system need updating to better support the transition to clean energy.

With the UK targeting net zero by 2050, tax policy will need to adapt to ensure businesses are incentivised to invest in green technologies rather than penalised for using them.

Next Steps

The government is inviting industry leaders, hydrogen producers, and stakeholders to have their say on the proposals.

Ministers want to make sure the reforms strike the right balance between cutting costs for clean energy producers and maintaining a fair tax system.